A bank statement shows the details of activity in a bank account over a set period of time. This is typically one month. Bank statements are generally issued as electronic account statements (aka ‘e-statements’). Alternatively, sent in the mail as paper documents. It is important to know how to read a bank statement correctly to not incur late fees.

How can I access my bank statement?

E-statements can be sent to your email address or accessed through your online banking service. E-statements will be available to download from the bank’s online portal.

Paper bank statements are mailed directly to the mailing address that the bank has on file. So make sure that it is correct!

Who can access my bank statement?

Only the account holder can access their bank statement. Unless you give out your account number, banks do not release information regarding your bank statement to unknown third parties without your consent.

What does a bank statement show?

The contents of a bank statement are pretty standard. The statement comes on the letterhead of your bank, which includes your bank’s information such as the bank’s name, address, phone number, and logo.

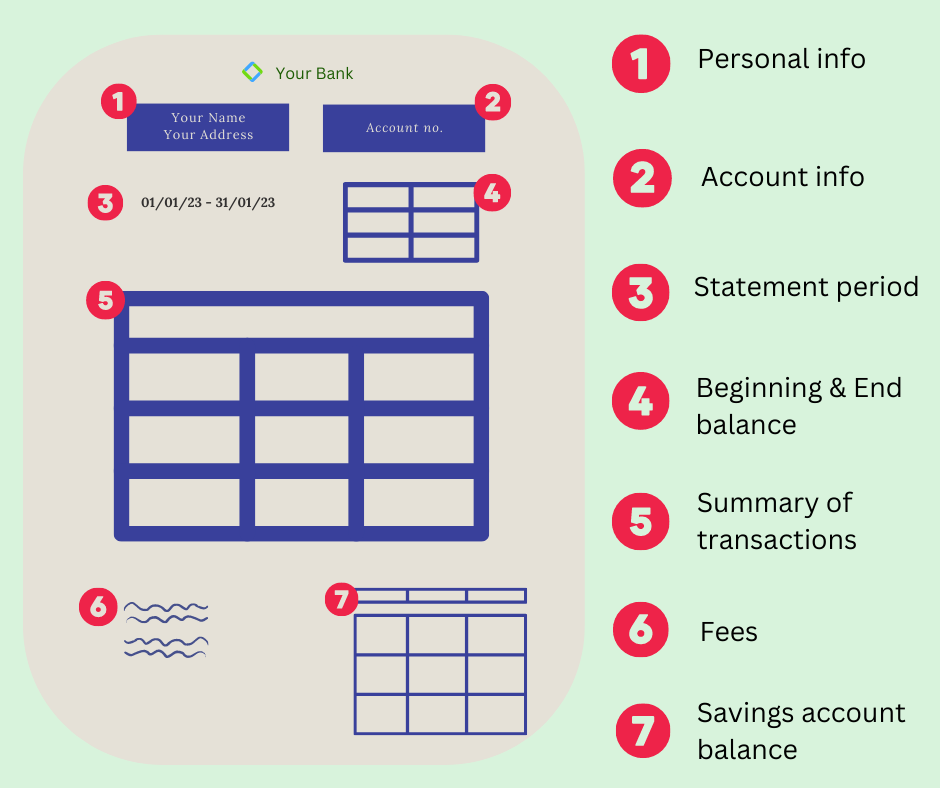

Thus, formatting can vary. But this is typically what information is on a bank statement: personal info, account info, statement period, beginning & end balance, a summary of transactions, fees, and lastly, savings account balance.

1. Personal information

The account holder’s full name as shown in their government ID, home address or national address, and sometimes phone number will appear on the bank statement.

2. Account information

You will see your account number as well as the type of account it is. (Savings, Current, and Credit Card accounts are the most common types).

3. Statement period

This means the period of time the bank statement covers, for example, January 1 to January 31, 2023.

4. Beginning and end balance

How much money did you have in this account on the first day of the statement period? How much did you have on the last day? These are the balances that will be on the statement, along with all the details of any activity in between.

5. Summary of transactions

Usually, transactions—which means money coming in (‘deposits’) and money going out (‘withdrawals’)—are listed in chronological order.

- Deposit: a payroll deposit if you have a job or an allowance — and how much they amounted to will be listed by date in the order they occurred.

- Withdrawal: anything that was spent will be listed as a withdrawal—for instance, if you tapped your debit card to buy lunch or a new set of headphones.

Similarly, this info is presented in columns. Generally, all details are listed by date and description, and the amount is noted in either the withdrawal or deposit column.

6. Fees

If the account has a monthly fee you’ll see this on the bank statement. Side note: always check the terms & conditions.

7. Savings account balance

Savings accounts often earn interest or monthly profits (with Islamic banking), where the bank pays you for keeping your money at their institution. How much you’ll see depends on how much money you have in the account and the interest rate of the account.

You can learn more about savings accounts here!

Why you should check your bank statements

It is important to look over your bank statement monthly to make sure that there is no fraudulent transaction or discrepancy. If there is, you must notify your bank as soon as possible.

A bank statement is also a great way for you to keep track of not just your expenses but also your saving goals as it can highlight your saving and spending habits! Looking over it frequently and reading the bank statement is a good habit!

Source: mydoh