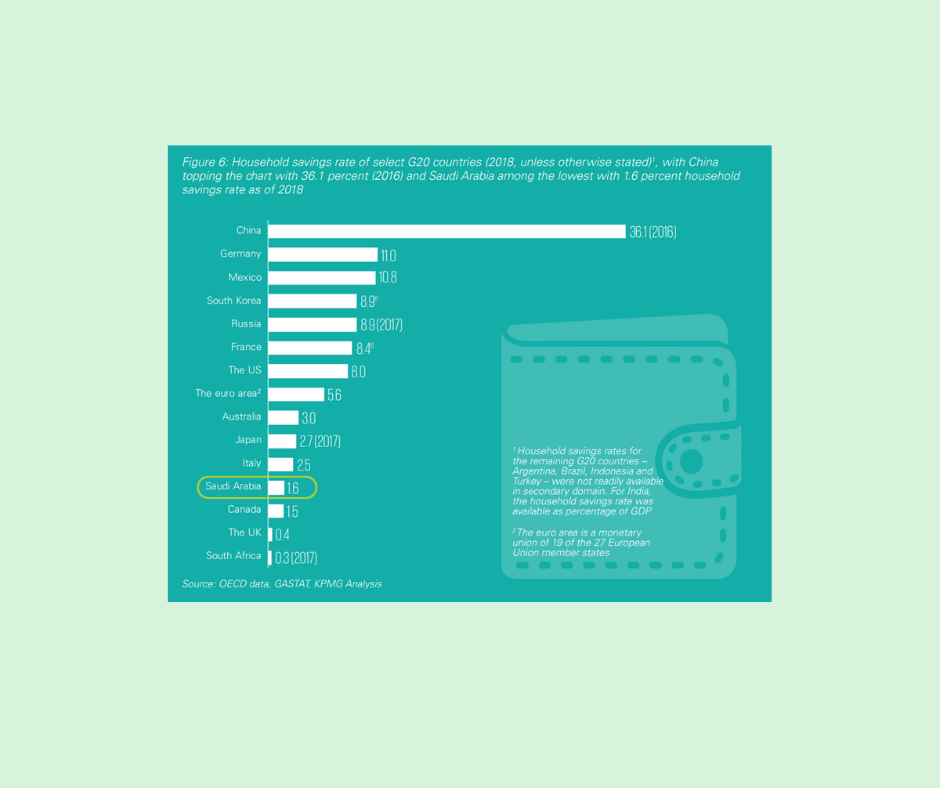

Did you know the average household savings in Saudi Arabia is 1.6%, which is less than the global average of 10% (as of 2018)? Across the world, many families live paycheck-to-paycheck and as a result, their financial situation is always a concern in the back of their minds. Thus, financial stress is a big concern for many.

Hard times come in very unpredictable moments in life. Although it is not something we can control, how we handle it is up to us. For many people, most of their daily stress comes from thinking about finances. This can negatively impact our lives and health, as stress manifests in various ways.

Now, while a lot of the causes of financial stress can be tied to external factors, being able to plan for tough times can greatly help alleviate and mitigate this form of stress.

So, what can you do?

Take measures to improve your financial stability. Look at what is in your control.

1. Take a look at your budget

We’d suggest you first tackle your budget. The best way to understand your financial stability is to look at your overall finances and that includes your budget.

Start by looking at your current finances and address any outstanding bills or payments due. If you have recurring payments that come in frequently, such as a phone bill or streaming subscription, consider this and see what you can do to maybe reduce the overall spending per month.

Look into how much you have saved. Think if it would be able to cover basic bills or even something more substantial for example, expensive repairs for appliances. If you have money saved for these forms of situations, you will have a safety net should you need it.

2. Look at your spending

When times are tough people tend to look at their spending and see where they can cut it and save money. We recommend you look at your spending habits and see what can be adjusted. Maybe even try to divide expenses based on needs and wants to better understand your spending habits.

3. Save for a rainy day!

We think it is best to plan for a rainy day as soon as possible. It is better to be proactive now and begin saving the moment you can. Put some money aside with every paycheck. You can put this in a separate saving account that you do not touch or in a physical jar that is kept away and only used for a rainy day.

Many banks offer services that allow adults to automatically put money into a savings account monthly. You can check to see if your bank offers this option.

It is important to have some form of savings that one can fall back to.

4. Track your habits

Track your progress. We all learn better if we have a clear visual guide to help us. To better understand how you are spending and saving your money, you can use an excel spreadsheet or use an app like FataFeat that will do the analysis for you!